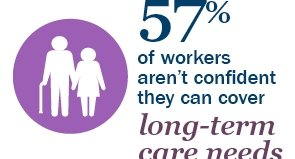

10 years out: Buying a long-term care (LTC) policy in your 50s may mean lower premiums as well as a greater likelihood of passing health care exams required by most providers. By age 65, you’ll have a 70% chance of needing LTC in the future.

The good news? Stand-alone LTC (long term care) with its “use it or lose it” drawback is becoming a thing of the past with the advent of a hybrid model that attaches an LTC rider to an individual life insurance policy at an additional cost: If you don’t end up needing LTC, unused funds pass on to heirs via an income-tax-free death benefit.

5 Years out: Now’s the time to revisit your plan and make any necessary changes in anticipation of retirement. In 2016, a couple age 65 with median drug expense needs was predicted to need $265,000 for a 90% chance of covering future health care costs. By the time you’re closer to retirement, that number is likely to have gone up with the trend toward rising health care costs. When you’re just a few years out, you’ll also have a better idea of current medical costs, any ongoing health concerns and your financial situation.

1 Year out: Nearly 6 in 10 people expect Medicare to cover most or all of their health care costs in retirement. Yet current Medicare benefits don’t cover routine dental care, eye exams, hearing aids and some of the other most common medical services in retirement. Supplemental Medicare coverage (“Medigap”), Medicare Advantage or private insurance can help pay for these costs, but a wide range of options means you’ll want to begin comparing plans well in advance of Medicare eligibility — currently age 65.

Not sure what options are best for you?

Contact me for a brief Free consult to help determine what works

best for your particular situation. 847-695-6690 or sandy.essex@bestltcadvice.com.

5 Years out: Now’s the time to revisit your plan and make any necessary changes in anticipation of retirement. In 2016, a couple age 65 with median drug expense needs was predicted to need $265,000 for a 90% chance of covering future health care costs. By the time you’re closer to retirement, that number is likely to have gone up with the trend toward rising health care costs. When you’re just a few years out, you’ll also have a better idea of current medical costs, any ongoing health concerns and your financial situation.

1 Year out: Nearly 6 in 10 people expect Medicare to cover most or all of their health care costs in retirement. Yet current Medicare benefits don’t cover routine dental care, eye exams, hearing aids and some of the other most common medical services in retirement. Supplemental Medicare coverage (“Medigap”), Medicare Advantage or private insurance can help pay for these costs, but a wide range of options means you’ll want to begin comparing plans well in advance of Medicare eligibility — currently age 65.

Not sure what options are best for you?

Contact me for a brief Free consult to help determine what works

best for your particular situation. 847-695-6690 or sandy.essex@bestltcadvice.com.