Women are losing sleep over this retirement savings fear

- Seven out of 10 women are “very concerned” about having enough money to cover their long-term care expenses, according to Nationwide.

- More than 60 percent of high-income adults over age 50 have no idea what their long-term care costs will be.

- Too often, families fail to discuss the financial impact of providing care.

CNBC.com

When it comes to retirement savings, living too long can be a blessing or a curse.

For women, who tend to outlive men and spend years caring for family members, it’s a major cause of anxiety. Those were the findings of a recent survey by the Nationwide Retirement Institute.

In February, the institute performed an online poll of 1,007 adults over age 50 with household income of at least $150,000 and 522 adults over age 50 who are or have been caregivers.

Of the participants, 71 percent of women said that they were worried about having enough money to pay for long-term care expenses.

That worry was especially keen among caregivers: 3 out of 4 said they were concerned about keeping up with long-term care costs.

Women feel the strain of long-term care keenly, as they tend to be the ones looking after their elderly and infirm parents and spouses.

“Sons want to care for mom and dad and be supportive, but they feel comfortable identifying an expert to navigate that,” said Joanna Gordon Martin, founder and CEO of Theia Senior Solutions.

“Daughters feel that it’s their responsibility to provide care, even if they don’t understand the complexity of the landscape,” she said.

Here’s what women need to know about planning for long-term care.

A slippery slope

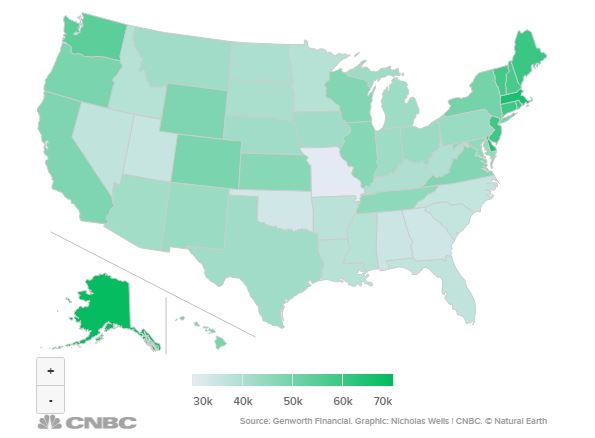

It’s no secret that paying for long-term care is a costly endeavor. In 2017, the annual national median cost of bringing in a home health aide was $49,192, according to data from Genworth.

A year’s worth of care in a semiprivate room at a nursing home is even more: $85,775 was the annual national median cost, according to Genworth.

See below for details on assisted living expenses.

Recruiting family members to help out with these needs adds on a different kind of cost.

Seven out of 10 of the participants in Nationwide’s study said they would like the option of relying on a family member if they needed long-term care.

Without the appropriate planning in place, things can quickly become overwhelming and may potentially endanger the caregiver’s career.

“It’s a slippery slope,” said Martin. “It starts with ‘I’ll go to one or two appointments’ and then it eventually becomes ‘I’ll fly down to Florida.'”

Indeed, on average, caregivers in Nationwide’s study said they spend 56 hours a week caring for loved ones.

Despite the fact that survey participants had a clear idea of how they wanted to be cared for, few people were talking to their family members about it.

About half of the individuals in the Nationwide study said they were speaking with their spouses about the cost of long-term care. Only 10 percent said they spoke with their kids about it.

“People want a family member to care for them, but they aren’t taking the steps to have the conversation,” said Holly Snyder, vice president of Nationwide’s life insurance business.

Here’s where to begin.

Talk to your spouse and the kids: You can’t prepare your family to provide care if you don’t make your wishes known well ahead of time. Work with your advisor and your family to discuss where and how to receive care, as those choices can be a significant factor in determining the cost.

Bring in your financial advisor: Your advisor can also help you come up with a way to pay for those expenses. Your funding choices for long-term care can include a traditional long-term care insurance policy, a hybrid cash-value life insurance policy to help cover these expenses or self-insuring with your own wealth — as long as you have the money.

Hammer out your legal documents: Head off legal battles at the pass. Get a health-care proxy in place so that you designate a trusted individual to oversee your medical care and ensure that professionals comply with your wishes in case you’re unable to communicate.

Also, consider a power of attorney for your finances. You would select a trusted person to make financial decisions for you and ensure your bills get paid if you’re incapacitated.

Don’t forget the small details: Imagine that your elderly parent has a medical emergency and is on the way to the hospital. Would you be able to answer questions on medications and allergies? Spell out those details in a written plan so that you’re ready.

“It’s not just the financials that are in play, but who are the doctors?” asked Martin. “What are the medications? Who will care for the dog? Have that plan in place.”

To take the next step, You can contact me from my info listed below or you can fill out this form for a call back,

I look forward to helping you.

Sandy Essex,

CLTC Long Term Care Planning Advisor

847.695.6690

Visit us at www.BestLtcAdvice.com

CLICK HERE to see the COST Of CARE IN YOUR AREA

To send me a Secured Email click here!

We take care of tomorrow, so you can focus on today!