Category: Long Term Care

Five Reasons Why People Buy

Long-Term Care Insurance

BURDEN TO FAMILY:Taking care of people who are chronically ill, can make the caregiver chronically ill. Long term care insurance allows children to maintain their relationship with their parents by helping supervise their care, rather than providing that care.

ACCESS TO QUALITY CARE: People want access to quality care

at home or at places of their choice, with caregivers of their choice.

ASSET PROTECTION: For those with assets, there are two ways you can pay for long term care – your retirement portfolio or long term care insurance.

CONTROL AND INDEPENDENCE: People want control and independence choosing where they live and the kind of care received.

PEACE OF MIND: Long term care doesn’t bring families together, it tears families apart. Long term care insurance brings families together and provides peace of mind.

What Long Term Care Insurance does:

What Long Term Care Insurance does: Help protect your finances from assisted care expenses. Thanks to advances in medicine, retirees are living longer, more independent lives. As a result, someone turning age 65 today has almost a 70% chance of needing some type of long-term care*. Although many people assume Medicare […]

Nov Is Long Term Care Awareness Month

A quarter of those age 65+ say

The Cost Of An Assisted Living Facility On Average Is

What is the Greatest Risk for Retired Seniors?

What is the Greatest Risk for Retired Seniors? October 1, 2019 | by Thomas Day By far, the greatest risk for retired seniors, especially those who are advanced in age, is the need for long-term care services. U.S. Department of Health and Human Services projections estimate that 70 percent of Americans who reach […]

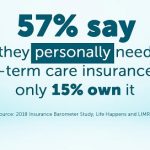

57 Percent Say They Need Long Term Care Insurance

Age is an issue of mind over matter

Today Is The Day 09-17-19 on Long Term Care Insurance Savings

Today Is The Day 09-17-19 on Long Term Care Insurance guaranteed premiums and payouts are increasing up to 80%. NO MATTER WHAT YOUR SITUATION IS, the best gift you can do is to PASS THIS ALONG TO THE PEOPLE YOU CARE ABOUT WHO HAVE NO PROTECTION TO INFORM THEM ABOUT POTENTIALLY GETTING COVERAGE and […]

Long Term Care Insurance guaranteed premiums and payouts are increasing up to 80%.

Final Notice 09-17-19 on Long Term Care Insurance guaranteed premiums and payouts are increasing up to 80%. NO MATTER WHAT YOUR SITUATION IS, the best gift you can do is to PASS THIS ALONG TO THE PEOPLE YOU CARE ABOUT WHO HAVE NO PROTECTION TO INFORM THEM ABOUT POTENTIALLY GETTING COVERAGE and take ADVANTAGE […]